Introduction:

Money with its power to shape destinies and influence lives has always been a subject of fascination and intrigue. The Money Psychology Book a groundbreaking exploration into the intricate web of human emotions and behaviors surrounding wealth delves deep into the psychological nuances that govern our relationship with money. Authored by leading psychologists and financial experts this book unravels the mysteries of why we make the financial decisions we do and how our mindset impacts our financial well-being.

Understanding the Money Mindset:

At the core of the Money Psychology Book lies the concept of the money mindset a term that encompasses the beliefs attitudes and emotions individuals associate with money. The book argues that our financial behaviors are not solely driven by rational decision making but are profoundly influenced by our subconscious beliefs about money. Exploring the roots of these beliefs the authors draw attention to the impact of childhood experiences cultural influences and societal expectations on our financial mindset.

The Psychological Triggers of Spending:

One of the key aspects illuminated in the Money Psychology Book is the role of psychological triggers in shaping our spending habits. Whether its the allure of instant gratification the desire for social status or the emotional need for comfort these triggers often lead us to make impulsive and sometimes irrational financial decisions. By dissecting these triggers the book provides readers with valuable insights into recognizing and managing the subconscious forces that drive their spending patterns.

The Influence of Social Comparison:

In the age of social media where everyone’s highlight reel is on display the Money Psychology Book sheds light on the pervasive impact of social comparison on our financial decisions. The constant exposure to others successes possessions and lifestyles can fuel a sense of inadequacy prompting individuals to spend beyond their means in an attempt to keep up. By dissecting the psychological mechanisms at play the book equips readers with tools to navigate the treacherous waters of comparison and build a healthier relationship with money.

The Fear and Anxiety of Scarcity:

The fear of scarcity deeply ingrained in human psychology often propels individuals to adopt unhealthy financial behaviors. The Money Psychology Book explores how the fear of not having enough can lead to hoarding excessive frugality or conversely reckless spending as a coping mechanism. By addressing the root causes of this fear and providing strategies to overcome it, the book empowers readers to cultivate a mindset of abundance and financial well-being.

Breaking the Taboo of Money Conversations:

One of the book’s groundbreaking contributions is its emphasis on the importance of open and honest money conversations. Money has long been considered a taboo topic, leading to a lack of communication within families and relationships. The Money Psychology Book argues that breaking this silence is crucial for fostering financial literacy, managing expectations, and building a shared vision of financial goals. By providing practical guidance on initiating and navigating these conversations, the book seeks to transform the way society approaches the subject of money.

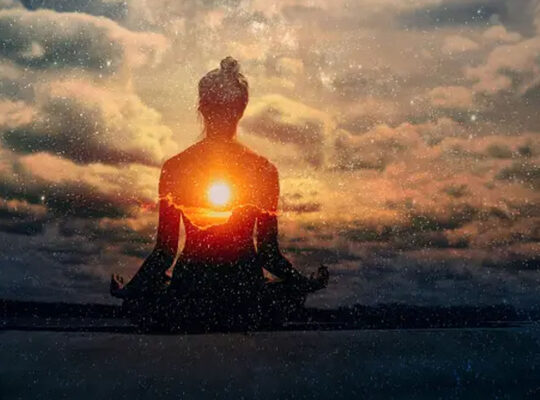

Investing in Emotional Wealth:

Beyond the realm of traditional financial wealth, the Money Psychology Book introduces the concept of emotional wealth — the satisfaction and fulfillment derived from a balanced and meaningful relationship with money. The book encourages readers to redefine their measures of success, emphasizing the importance of well-being, purpose, and contentment over material accumulation. By guiding individuals toward a more holistic approach to wealth, the book aims to contribute to a happier and more fulfilled society.

Conclusion:

The Money Psychology Book is not just a guide to financial literacy but a profound exploration of the intricate dance between the human mind and money. By unraveling the layers of psychological complexity that surround our financial decisions, the book provides readers with the tools to navigate the often turbulent waters of personal finance. It is a call to action, challenging individuals to reflect on their money mindset, engage in open conversations, and ultimately redefine their relationship with wealth in pursuit of a more fulfilling and balanced life.