Introduction:

Corporate finance is the heartbeat of business operations encompassing a set of activities and decisions crucial for the financial health and sustainability of a company. From capital management to investment decisions corporate finance plays a pivotal role in shaping the financial strategy of organizations. In this article we will explore the key components of corporate finance the strategic decision making process and its impact on the overall success and growth of businesses.

Key Components of Corporate Finance:

Capital Budgeting:Capital budgeting involves evaluating and selecting investment opportunities that align with the long term goals of the company. This process includes analyzing potential projects estimating their cash flows and assessing their risk and return profiles. The goal is to allocate resources efficiently to projects that maximize shareholder value.

Capital Structure:Determining the optimal capital structure is a critical aspect of corporate finance. It involves deciding on the right mix of equity and debt to finance the company operations. Striking the right balance helps minimize the cost of capital while maintaining a healthy level of financial leverage.

Working Capital Management:Efficient working capital management ensures that a company can meet its short term obligations and operational needs. This involves managing cash flow accounts receivable and inventory to optimize liquidity and support day to day operations.

Dividend Policy:Corporate finance also addresses the distribution of profits to shareholders through dividend payments. Companies must strike a balance between reinvesting profits for growth and returning value to shareholders in the form of dividends.

Strategic Decision-Making in Corporate Finance:

Risk Management:Assessing and managing risks is integral to corporate finance. This includes identifying potential financial operational and market risks and implementing strategies to mitigate them. Risk management ensures the company can navigate uncertainties and safeguard its financial health.

Cost of Capital Optimization:The cost of capital is the price a company pays to raise funds. Corporate finance strategies aim to optimize the cost of capital by choosing the right mix of debt and equity and negotiating favorable terms. Lowering the cost of capital enhances the company overall financial performance.

Mergers and Acquisitions (M&A):M&A activities are a strategic component of corporate finance, allowing companies to expand, diversify, or gain a competitive edge. Financial analysts and corporate finance professionals play a crucial role in evaluating potential acquisitions, conducting due diligence, and structuring deals that align with the company’s goals.

Financial Planning and Forecasting:Robust financial planning involves creating realistic projections and forecasts to guide decision-making. Corporate finance professionals analyze historical data, market trends, and external factors to develop accurate financial models that inform strategic planning and resource allocation.

Corporate Finance for Sustainable Growth:

Sustainability Integration:Modern corporate finance is increasingly focused on sustainability. Companies are integrating environmental, social, and governance (ESG) considerations into financial decision-making. Sustainable finance practices not only contribute to corporate responsibility but also enhance long-term resilience and value creation.

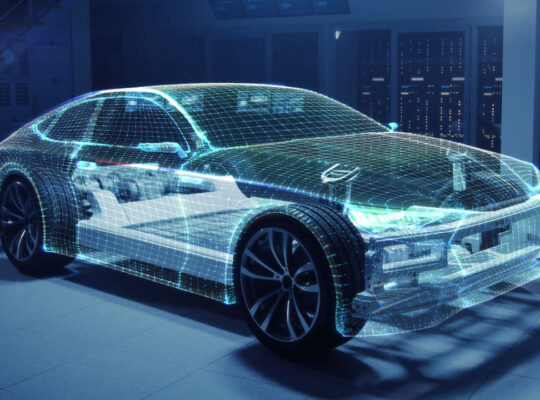

Innovation and Technology:Embracing innovation and technology is vital for corporate finance in the digital age. Fintech solutions, data analytics, and automation are transforming financial processes, improving efficiency, and providing valuable insights for strategic decision-making.

Global Expansion:As businesses operate in an increasingly interconnected world, corporate finance strategies often involve global expansion. This includes navigating international tax considerations, managing currency risks, and adapting financial structures to accommodate diverse regulatory environments.

Adaptation to Economic Trends:Corporate finance strategies need to be agile and adaptive to economic trends. Whether navigating economic downturns or capitalizing on periods of growth, effective financial planning and decision-making are essential for ensuring the company’s resilience and competitiveness.

Challenges in Corporate Finance:

Market Volatility:Fluctuations in financial markets can pose challenges for corporate finance professionals. Managing market risks and adapting to changing economic conditions require agility and a deep understanding of market dynamics.

Regulatory Compliance:Staying compliant with an ever-evolving regulatory landscape is a continuous challenge. Corporate finance professionals must navigate complex regulations, ensuring transparency and accountability in financial reporting and decision-making.

Access to Capital:The ability to secure funding, whether through debt or equity, is a perpetual challenge for businesses. Economic conditions, industry trends, and the company’s financial health impact its ability to access capital for growth and operations.

Conclusion:

Corporate finance is the backbone of strategic decision-making for businesses, shaping their financial health and trajectory. As companies navigate an increasingly complex and dynamic business environment, corporate finance professionals play a crucial role in optimizing resources, managing risks, and driving sustainable growth. The integration of innovative technologies, sustainability considerations, and a proactive approach to economic trends positions corporate finance as a key driver of success in the ever-evolving world of business. By embracing strategic financial planning and decision-making, companies can not only weather challenges but also thrive and build a resilient foundation for the future.